Items That Will Not Be Reclassified to Profit or Loss

There are certain items that are not reclassified to profit or loss according to IFRS Standards. Items that will not be reclassified to profit or loss.

Solved Financial Statements Income Statement For The Year Chegg Com

The share of the other comprehensive income of associates and joint ventures accounted for using the equity method separated into the share of items that in accordance with other IFRSs.

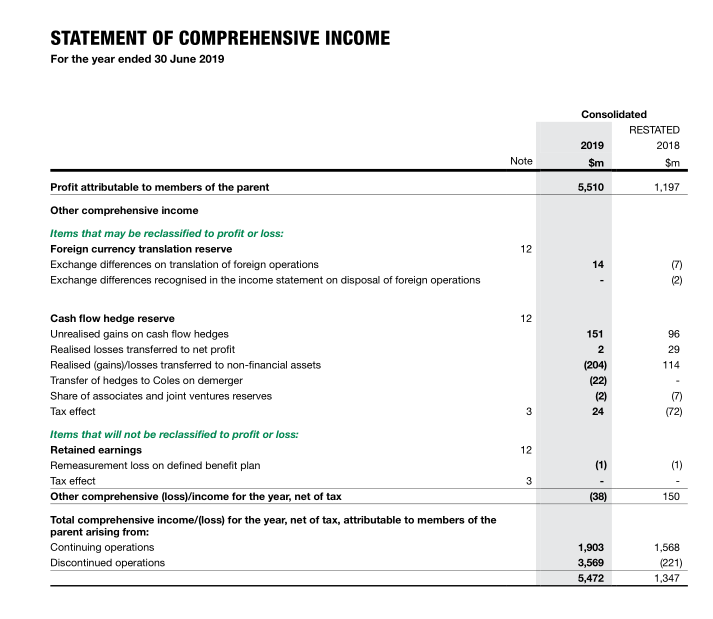

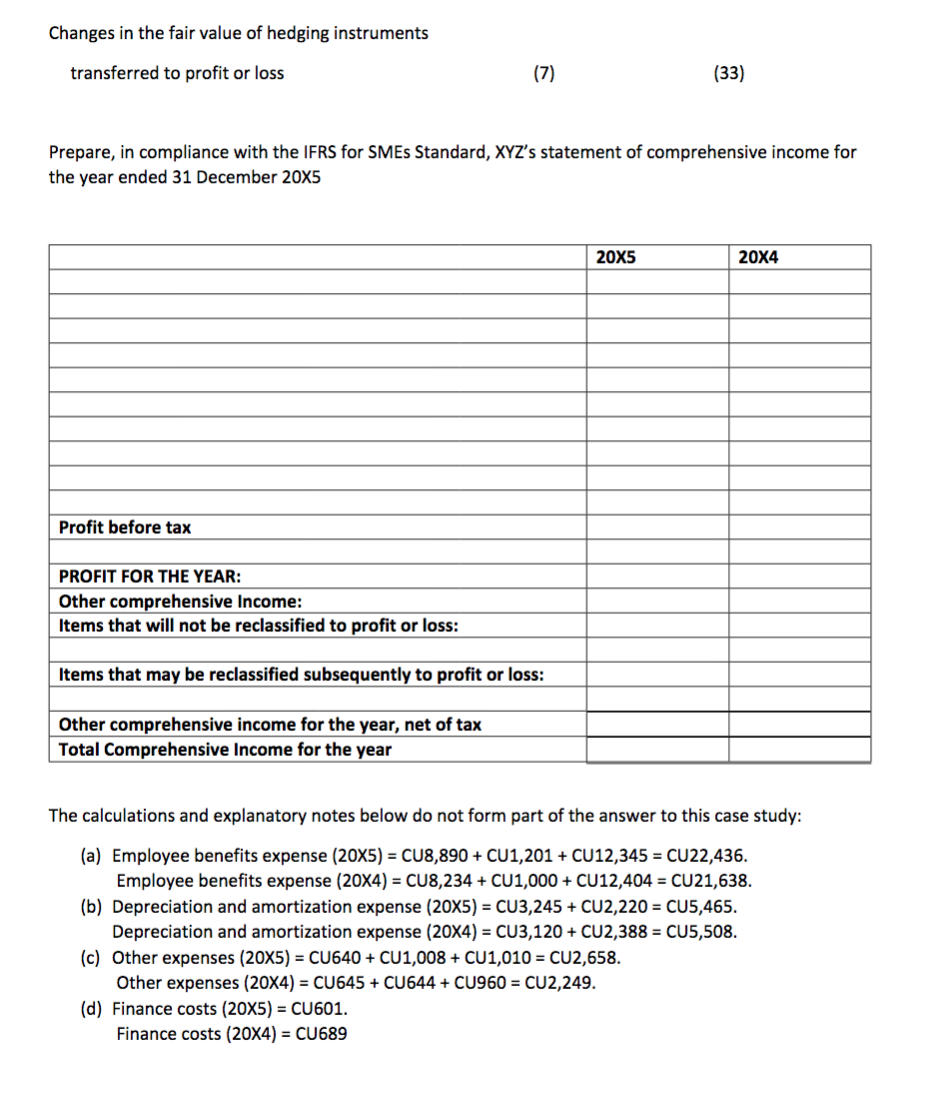

. Remeasurement of net defined benefit liability lossgain from investments in equity instruments measured at FVTOCI. Transfer from legal reserve 1 - NM Items that may be reclassified subsequently to profit or loss Foreign currency translation 188 - NM Other comprehensive income for the period net of tax 188 38 NM. The following minimum line items must be presented in the profit or loss section or separate statement of profit or loss if presented.

Translation of financial statements of a foreign operation. All of the following components of OCI should be reclassified to profit or loss except. Loss from operations 400 466 -142 Interest income 3 6 -500.

Remeasurement loss on defined benefit plans D. Comprehensive Income that will not be routed through Profit And loss book profit of the previous year shall be increaseddecreased by all amounts crediteddebited to other. Unrealized loss on equity investment at FVOCI C.

Tax related to OCI item should that cannot be reclassified to PL. A changes in revaluation surplus see Ind AS 16 Property Plant and Equipmentand Ind AS 38 Intangible Assets. Statement of Comprehensive Income.

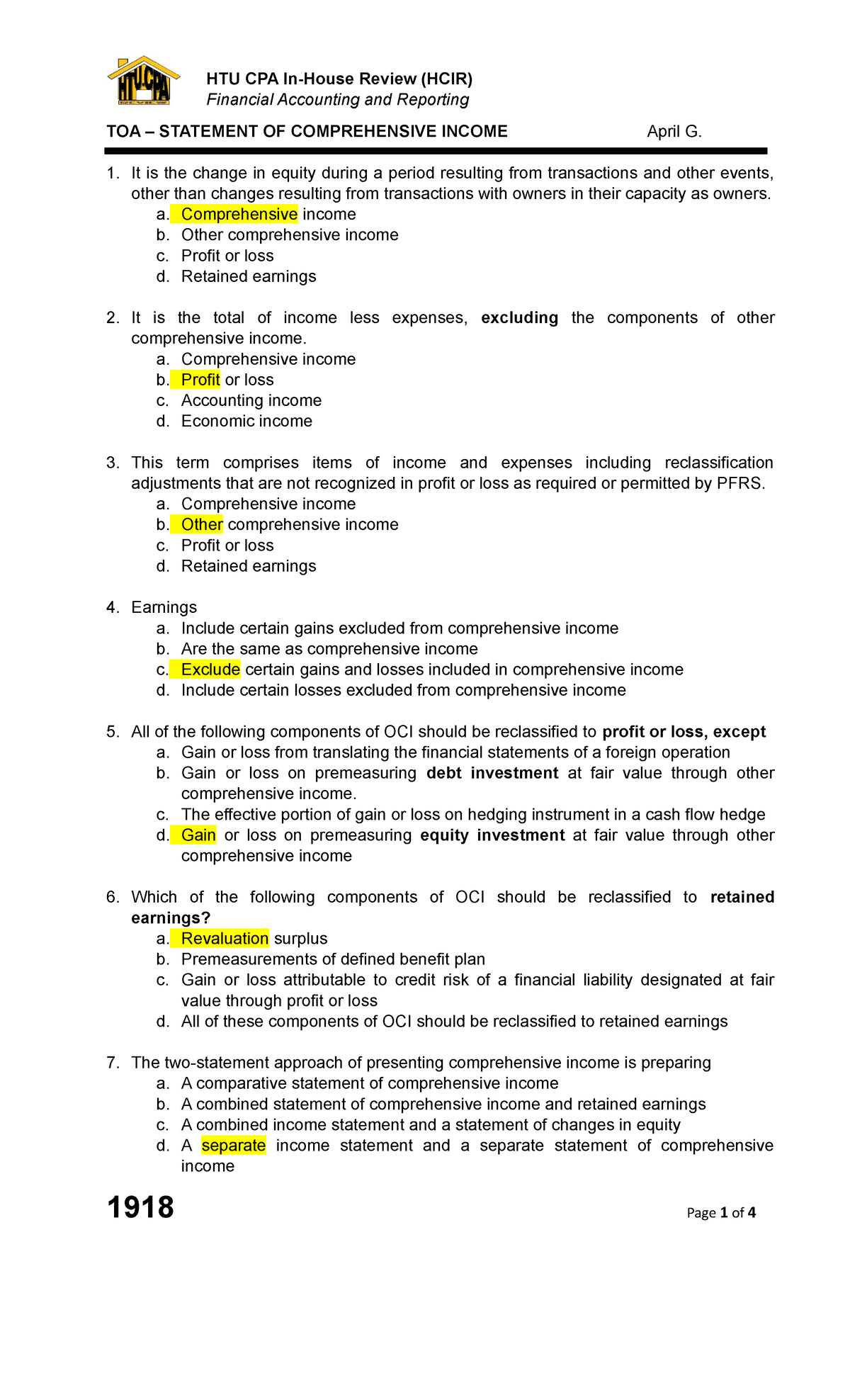

Items that might be reclassified or recycled to profit or. The IAS 1 amendments clarify that the entitys share of items of. It comprises items of income and expense including reclassification adjustments that are not recognized in profit or loss as required or permitted by PFRS.

Remeasurement of debt. OCI items that cannot be reclassified into profit or loss. Items that cannot be reclassified into PL.

Components of other comprehensive income that will not be reclassified to profit or loss net of tax. Gains and losses from the derecognition of financial assets measured at amortised cost. Will not be reclassified subsequently to profit or.

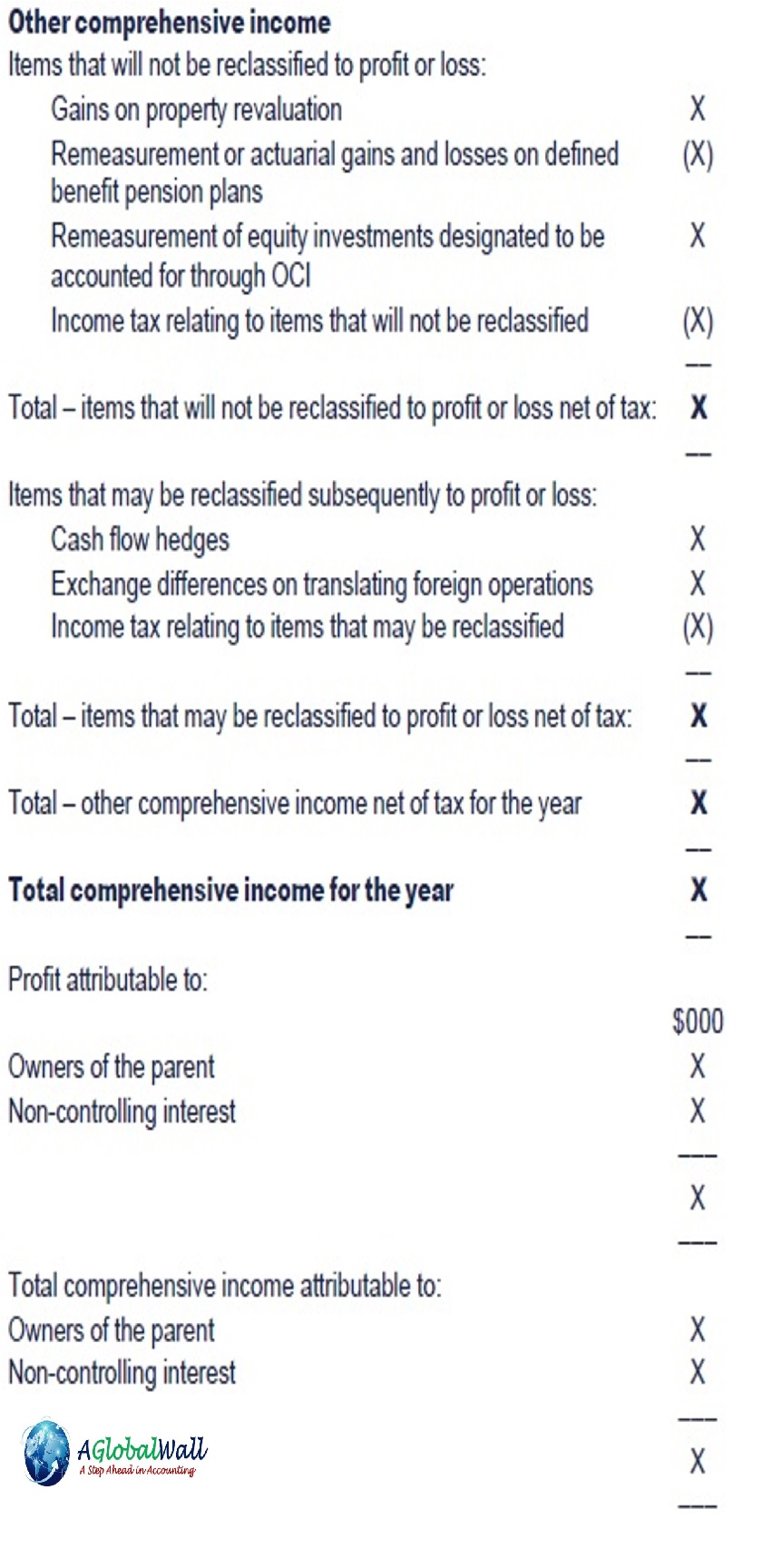

An entity presents items of other comprehensive income grouped into those that will be reclassified subsequently to profit or loss and those that will not be reclassified. Items that will not be reclassified to profit or loss Share of lossgain on property revaluation of associated company 364 37 -10838 Items that may be reclassified subsequently to profit or loss Foreign currency translation 232 84 -3762. Gains on property revaluation X X Remeasurements on defined benefit pension plans X X Share of gain loss on property revaluation of associates X X Income tax relating to items that will not be reclassified X X X X Items that may be reclassified subsequently to profit or loss.

In order to tax items of. An entity discloses reclassification adjustments relating to components of other comprehensive income. And from some statements it is said that the items will never be reclassified and in another it may say that items below will be reclassified.

In thousands of Euro Note 2013 2012 Net result before non-controlling interests 24731 31451 Other Comprehensive Income Items that will not be reclassified to profit or loss - Actuarial gain loss212965 3370 - Tax on items that will not be reclassified to profit or loss211170 1335 Total items that will. Kindly assist in explaining how why and when items are and not reclassified from OCI to Profit or loss. Book Profit for the purpose of.

Will be reclassified subsequently to profit or loss when specific conditions are met. Will not be reclassified subsequently to profit or loss. Other comprehensive income comprises items of income and expense including reclassification adjustments that are not recognized in profit or loss as required or permitted by other Ind ASs.

Items that will not be reclassified to profit and loss 82A classifications within OCI Revaluation of land and buildings Unit 7 Income tax on items that will not be reclassified Items that are or may be reclassified to profit and loss 82A Foreign currency translations of overseas subsidiaries Unit 5 FVTOCI investments Net change in fair value Unit 9 Reclassification to profit and loss 92. OCI Not Reclassified To Profit Or Loss. Total comprehensive income TCI is the total of the entitys profit or loss and other comprehensive income for the period.

Accounting questions and answers. Section 115JB is Net Profit before Other Comprehensive Income. These include revaluation of property plant and equipment International Account Standard IAS 16 revaluation of intangible assets IAS 38 and remeasurements of.

Examples of other comprehensive income items that would never be reclassified to profit or loss are changes in a revaluation surplus recognised in accordance with IAS 16 Property Plant and Equipment and actuarial gains and losses on defined benefit pension plans recognised in accordance with IAS 19 Employee Benefits. An example of items recognised in OCI that may be reclassified to profit or loss are foreign currency gains on the disposal of a foreign operation and realised gains or losses on cashflow hedges. OCI Not Reclassified To Profit Or Loss OCI Exchange Differences On Translation OCI Actuarial Gains On Defined Benefit Plans OCI From Gains On Revaluation.

All of the following OCI items may not be reclassified to profit or loss except A. Items that will not be re-classified to profit or loss. I have been unable to understand what it is that gets reclassified or not and when.

Items that will not be reclassified to profit or loss. Those items that may not be reclassified are changes in a revaluation surplus under IAS 16 Property Plant and Equipment and actuarial gains and losses on a defined. May 17 2017.

Unrealized loss on debt investment at FVOCI B. FVTPL- Changes in fair value attributable to changes in the liabilitys credit risk. Changes in revaluation surplus IAS 16 and IAS 38 Actuarial gains and losses on defined benefit plans IAS 1993A Gains and losses from investments in equity instruments measured at.

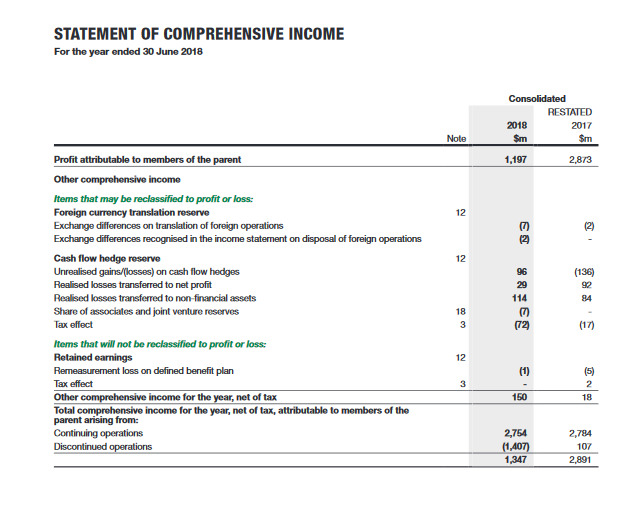

Staff recommended revising paragraph 82A through an annual improvement to clarify that the requirements of IAS 1 concerning the presentation of items of OCI arising from equity accounted investments shall be presented in aggregate in a two line items classified by whether or not they may be reclassified to profit or loss. CONSOLIDATED STATEMENT OF OTHER COMPREHENSIVE INCOME. IAS 1 requires that OCI is classified into two groups as follows.

And to revise the Implementation.

Ias 1 Presentation Of Financial Statements Acca Study Material

Other Comprehensive Income Oci In An Ifrs Income Statement Rev 2020 Youtube

Actg 6580 Chapters 4 And 5 Income Statement Statement Of Financial Position And Statement Of Cash Flows Ppt Video Online Download

Ignore This Recycled Profit Ping An The Footnotes Analyst

Heads Up Fasb Finalizes New Disclosure Requirements For Reclassification Adjustments Out Of Aoci

Statement Of Profit Or Loss And Other Comprehensive Income Download Scientific Diagram

Ignore This Recycled Profit Ping An The Footnotes Analyst

Company Xyz Prepares Its Statement Of Comprehensive Chegg Com

Other Comprehensive Income Caglobal

Why Isn T Comprehensive Income Comprehensible Strategic Finance

Other Comprehensive Income Caglobal

1918 Toa Statement Of Comprehensive Income Accountancy Studocu

Assume That You Are Also Considering To Invest In The Chegg Com

Statement Of Profit Or Loss And Other Comprehensive Income Download Scientific Diagram

Ifrs Example Financial Statements 2018 Annual Reporting

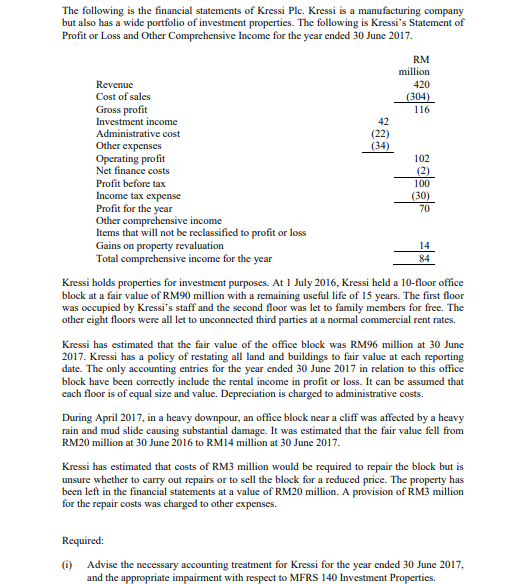

The Following Is The Financial Statements Of Kressi Chegg Com

Profit Loss And Other Comprehensive Income Acca Global

How Sap Financial Consolidation Starter Kit Meets Ifrs Requirements Ias 1 Sap Blogs

Financial Statement Presentation Statement Of Cash Flows Ppt Download

Comments

Post a Comment